The purpose of this blog is to document my journey toward financial independence.

In 2014, I set a goal to become a self-made millionaire by December 31, 2024.

Long-term readers know that I immigrated to Canada from a financial-poor third world country and completed my undergraduate degrees with the help of student’s loans program, and ended up with over $56 000 student loan debts.

Recovering from this deep debt was a difficult task without any supports. After landed in a decent job, I had two choices – either paying down debts or invest in assets and pay the debts later.

Financial experts usually say to pay down debts first and invest later.

I decided to handle the situations differently – reverse engineering. I started to invest first without reducing debts.

In fact, I used some debts to buy income generating assets (dividend growth stocks). And also I bought a small house using a mortgage.

Therefore, I started to build assets instead of worry about debts.

As a result, my debt ballooned to over $330 K; however, I didn’t worry about it because the interest rate was cheap enough so the debt service fees were lower.

But, the situation has changed a bit now. The rate started to move up, which keeps telling me to put a break on debt growth.

So I decided to reduce my debts a bit last year. I set a goal to bring down my debts below $315K, but I couldn’t achieve the goal; however, I reduced my debts from $327 100 to $322 700 – reduced by $44 00. It is not a significant reduction, but I made the progress.

Currently, I don’t have any idea to eliminate my debts completely. But I just wanted to reduce my debts in my comfort zone of less than $300 000. I am very comfortable with having less than $300 000 debts with my current income level.

In 2019, I will continue focusing on assets accumulation and income growth, at the same time I will be controlling my debts growth.

I successfully achieved my two other goals set in 2018.

I will continue to make yearly goals, so I could get a few steps toward my ultimate goal of financial freedom in 2024.

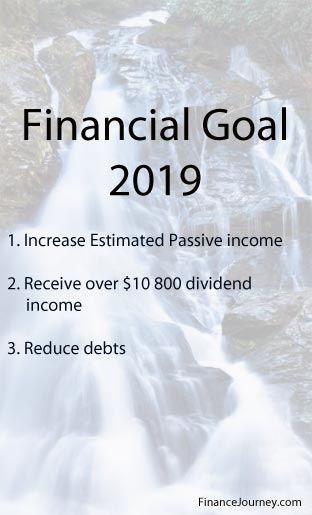

2019 Financial goals

I have been setting yearly financial goals each and every year for last couple of years them sharing them publicly in this blog.

I noticed that when I share my goals publicly I am getting a powerful internal pressure, which forces me to think and take necessary actions to achieve the goals.

In the past, I have successfully accomplished some goals and failed some as well. Even though I failed few, I tried my best and reached somewhere closer.

Again, I am going to set three financial goals for 2019,

- Goal 1: Increase my estimated passive income (EPI) to $11 500 by December 31, 2019

It is $1900 higher than my 2018 goal. This can be reached by increasing my EPI by around $150 per month.

- Goal 2: Receive over $10 800 dividend income for the year 2019 (by December 31, 2019)

It is $1800 higher than year 2018 goal.

- Goal 3: Reduce my debts to $310 000 or below.

My debts was $322 700 by end of 2018. I just need to reduce by around $1000 per month.

If I can achieve these goals, then my 2020 goals will be $14 000 estimated passive income and bring down debts to $300 000 or below.

Check my progress and previous yearly goals in my financial goal page.

Leave a Reply