I am so excited to announce that we reached our first $50 000 net worth. Yesterday, May 09, 2014, we received our 2013 tax refund worth more than $5000 which brings up our net worth to $54 000. My net worth may looks small amount for some of you, but it is absolutely a big milestone for me as I was in deep debt after I graduated from university with massive student loan.

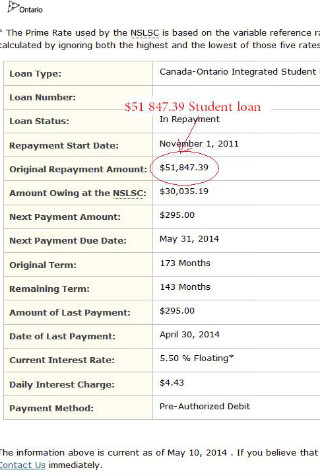

I graduated from a Canadian university in 2011 with two degrees and $51 847.39 student loans. I was struggling to find a decent job at the beginning and luckily landed in a dream job (in my passion) with a lower middle class salary range.

After I got the job, I put extra money into my student loan and brought down the amount from $50k to $30k range and slowly started invest in dividend stocks. My investment return was much higher than the interest I pay the loan. Moreover, the loans interest is tax detectable.

So, I decided to focus more on dividend investing and also borrowed more money from low interest credit cards (maximum 1.9% interest) to add more high quality stocks in my portfolio. This leverage approach was little high risk, but it rewarded really well as my investment return was more than 40% in last 2 years.

I know that we may not get similar return in the future, but I am so confident that we can get a solid passive growing dividend income from my investment.

Now, we are aggressively looking to buy a small house because we are paying around $1000 rent for a tiny one bedroom apartment, and thought we could save some money if we have a house our own.

I will use this tax return to pay down some credit card debts for this year as we need to maintain a good credit history in order to get a good mortgage interest rate.

What does this first $50 000 net worth mean to us?

We achieved 5% of our million dollar dream. It took us more than 3 years to get from negative $50 000 to positive $50 000. In this first $50 000 finance journey, we made some difficult decisions, took modest risk, achieved lot of success and passed through some failures.What is next?

Of course, we will continue our finance journey to the second $50 000 net worth. Unfortunately, I did not fully document my passed finance journey, but, for sure, I will document my future finance journey in this website. Keep in touch.Thank you for reading.

S Arun,

Congrats on your big milestone, my friend. Next stop is $100k, and you’ll surely get there faster than you did from $0 to $50k. 🙂

Keep up the great work!

Best wishes.

Hi DM,

Thank you for your kind words, I hope to get the $100k net worth by the end the year.

Good luck for your new life journey.

Best regards,

First chunk of money is always the hardest. After a while growing your net worth becomes easier and easier. Keep up the good fight!

Hi Financial Underdog,

Thank you stopping by. I hope we can get the second $50 000 bit easier than the first one.

Cheers,

Congrats on reaching your first 50K! Good call on borrowing at a low interest rate to invest. I am still getting offers from my credit card to borrow at 1% and am considering borrowing to invest.

Best wishes to your next goal of reaching 100K in net worth next year.

regards

R2R

Thank you for your support R2R,

It is little risky to borrow money to invest, but if you borrow at 1% and invest in high quality dividend paying stocks that yields around 4% is not risky as many people think.

Best regards,

Just a little bit of info on this topic.

The flip side of this leverage approach is not having the cash to repay the loan that could go to 19- 33%. Just remember that the gain in the portfolio is not realized until you sell and then capital gains come into play. All the while, the loan is just aching to grow larger. So, if the money is needed to repay loan and you sell, you owe taxes and have to come up with cash for that or have a lesser tax refund. Also, if the market happens to absolutely crash the day before you have to cash out to pay the bill, you might also be unable to cover the balance on the credit card, and potentially end up with way less than you started with. Leverage is great when you win, but it is crazy bad when you lose. Just be careful.

Good luck,

Robert

By the way, it happened to me in 1999, with a stock called Cutter and Buck. It was almost shorted out of existence. From 21.00 to 2.00 in short order, but i had the cash to cover the $38,000 loan. If not for that, the losses would have been catostrophic at the time and I would not have collected the special dividend or the rebound from the buyout. Lot more to the story, but the math is the same regarfless of the stock- Anything can happen.

Good luck,

Robert

Thank you Robert for kind advise,

I always ensure to have some cash (may be using margin loan) to repay the credit loan when the promotion periods end, for some reason, my credit card lenders are more than happy to extend/renew the promotion periods. You are absolutely correct that “Leverage is great when you win, but it is crazy when you lose”.

I never heard about the stock called ‘Cutter and Buck’, I googled it and learned that it crashed in early 2k and had a fraud cases at top level. But, for me I wouldn’t invest in clothing stocks or other businesses that sell nonessential goods and services. People will avoid to buy their products or services if they don’t have money, I mean the recession period. Also, I won’t invest in more than $10 000 in just one stock. I will have around 50 high quality companies, so, dividend cut or crash in company won’t affect the overall performance of my portfolio.

Honestly, I’m little scare after read your comments, I will be careful when I borrow money to invest.

Thank you once again for the advise and sharing your experience. Hopefully, I will learn a lot from readers.

Best Regards,

I think you have been very humble and shy. Do not need to be.

In less than 3 years time you paid off $51K and saved another $50K. It is almost of $35K a side for a recent grad.

It took me 6 years after university before I could afford saving such amount of money: http://www.niterainbow.com/search/label/Goals

You will get there in no time.

Thank you Financial Independence,

Well planning, hard working working and our leveraged approach helped us to reach to this point. Hopefully, we will do even better in coming years.

Cheers,

Congrats! I know you have long way to go, but “always the first step is the hardest things to do”. You finished your first step, your second (second $50000) step will be lot easier than your first step. Good luck!

Thank you Chris,

I hope to reach my second $50 000 in one year or less.

Cheers